Dell is a must-buy. That's all, folks! Thanks for stopping by.

Okay, just kidding - there's a lot more to the Dell Story than that.

Background: State of the Nasdaq

If you'll permit me a gross oversimplification of the tech stock (QQQ) landscape, there are essentially two types of tech stocks/companies. There's "old tech," AKA anything PC-related, and there's "new tech," AKA anything mobile-computing or social-media related.

What's the primary difference? Well, the first group is cheap. The second group is expensive.

So while everyone else is chasing momo growth stocks like LinkedIn (LNKD), Facebook (FB), Zynga (ZNGA), and Groupon (GRPN), I'll take a nice nap in the bargain bin with Dell (DELL), Intel (INTC), Cisco (CSCO), Seagate Technology (STX), and Microsoft (MSFT).

I've articulated my bullish stance on "old tech" several times. My core thesis is based on three bullet points:

- "Old tech" companies have been hit hard by (unjustified) fears about the impending death of the PC.

- This has caused their valuations to plunge dramatically into "value" territory.

- Deep value stocks outperform: "The cheapest one-10th of U.S. stocks relative to projected earnings have outperformed the most expensive one-tenth by 9.1 percentage points a year on average since 1968, according to Brandes Investment Partners.")

The focus of this article, Dell, fits the above three points to a T - it currently trades at an absurdly low 6.6 P/E based on guided earnings of $1.70 for the year. And that's why I love it.

The rest of this analysis is dividend into three parts: first, Dell's PC business. Second, Dell's non-PC business. Third, Dell's shareholder-friendly policies.

Dell-Icious: The PC side

The next time someone says "Apple (AAPL) killed the PC," refer them to the following two pieces of information.

- Apple hasn't "killed the PC." While desktops and notebooks don't have the same explosive growth rate as smartphones and tablets, both categories registered growth in 2011, with 209M notebooks and 112M desktops shipped. The latest data shows worldwide PC shipments dipped only 0.1% year-on-year during Q2 (note that US shipments dropped 6 to 11% year-on-year). Neither of those stats suggest that the PC is "dead." Limping, maybe. Dead, no.

- Apple has no interest in "killing the PC" - sorry to burst your bubble, but Apple actually sells PCs. MacBook Pro, anyone?

Now that we've established that the PC isn't actually dying, we can take a look at the elephant in the room: Dell's latest quarterly report. Both Dell and Hewlett-Packard (HPQ) had terrible earnings reports. These were widely-reported, as was a rather gloomy quote from Dell CFO Brian Gladden:

the revenue sort of deterioration we saw in the quarter was clearly above anything we expected.

At first, it sounds like pretty convincing evidence that the PC is "dying." But in reality, the quote was taken out of context. Gladden went on to say:

And I think that's something that as we think about moving forward, you can't expect that, that business will have that sort of deterioration over a long period of time. We think, as you look at the second half of the year, it's going to be challenging environment for that part of the business, but should stabilize as we come out of that and get Windows 8 sort of in the marketplace.

(Full transcript of the earnings call here, for those interested.)

Now, I don't blame journalists for jumping on the juicy sentence - after all, it is election season, and everyone needs to practice their grabbing-soundbites-out-of-context-skills. But when you look at his full explanation, and contextualize that with the latest data showing that worldwide PC sales were only down 0.1% in Q2.

As for sales being down 6 to 11% in the US, well, you can thank Windows 8 and the Osborne effect [and no, the Osborne effect has nothing to do with Justin Bieber and Ozzie Osbourne permanently scaring customers away from Best Buy (BBY)]. For those of you unfamiliar with the term, the "Osborne effect" refers to the fact that when customers know a new-and-improved version of a technology product is slated for release, they're less likely to buy the old models on the shelves. With the release of Windows 8 and mysterious "converged devices" ahead, it's safe to say that computer sales will start to improve again.

Think the current dip in PC shipments is unique? It's not. PC shipments also dipped prior to the release of Windows 7 and Windows XP, although there were of course other factors (like macro headwinds) affecting shipments. But when considering Dell's weak quarter and even worse guidance, keep in mind that there are macro headwinds right now. Tech god Apple also reported a substandard quarter (desktop Macs revenue down 19% year-on-year) and offered pretty awful guidance as well. It's not just Dell that's struggling - it's the computer industry (and economy) as a whole.

So, analyze Dell's latest quarter couched in that context. Is the PC business struggling? Undoubtedly. But is it struggling so badly that a 6.6 P/E is justified? Hardly.

Even More Dell-Icious: The Non-PC Side

Herein lies what I'm most excited about as a Dell shareholder. While the world sees Dell as "that PC company," Dell sees itself in a somewhat different light:

I am excited about our future. Information technology is a $3 trillion industry, and we currently have roughly a two-percent share. - Michael Dell, FY 2012 Letter From The Chairman

If Mr. Dell's enterprise focus isn't clear enough in the letter, it's pretty clear in this interview:

Well, in the last five years or so, we've really made a concerted shift in our business towards end-to-end IT solutions. [...] The next business for us is the enterprise data center, the server, storage, networking business. We make about a third of the servers that are on the Internet and about a third of the servers in North America, you know, built a tremendous business in storage and networking, fueled by some acquisitions.

Does that sound like "just a PC company" to you? No? Me neither. But talk is cheap, so let's pay attention to the financial data:

[H]erein lies some of the difficulty in looking at Dell strictly from a revenue standpoint because the business mix is shifting.

So, we're already at about half of our gross margin is not the PC. You know, last year our cash flow grew 39 percent, the $5.5 billion. So, the business mix is changing pretty dramatically and what I just kind of described is the new Dell in the last five years, that's gone from about $10-billion business to about a $20-billion business.

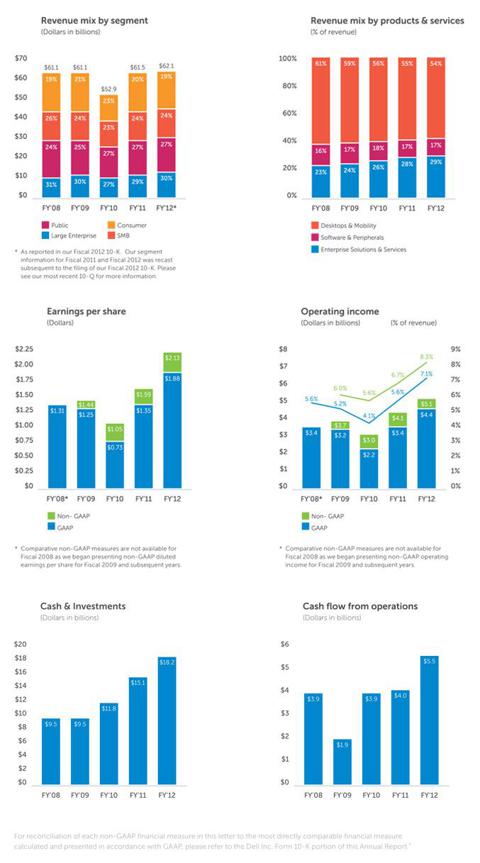

Indeed, this nice little graphic from Dell's FY2012 report demonstrates how Enterprise Solutions has been growing as a share of revenue. As of FY12, it's up to 29%, representing roughly $18B of revenue.

(click to enlarge)

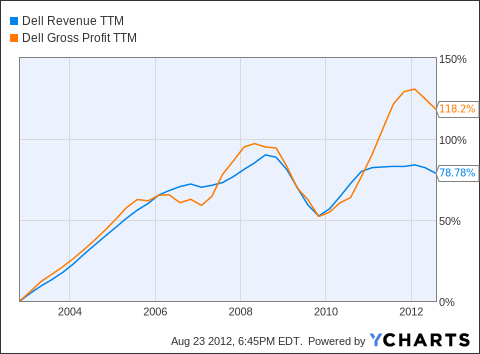

The change in business model is a welcome refresher for Dell shareholders. As Michael Dell said, cash flow is growing. Even with flat revenue, the new business model is a lot more profitable. Take a look at the following chart, which illustrates the point nicely. From 2002 through 2010, revenue and profit moved almost like twins. But since then, they've decoupled, and despite mostly flat revenue, profit has increased dramatically.

DELL Revenue TTM data by YCharts

Is this new era of growth over for Dell? Not a chance. While there may be headwinds for PCs, there are certainly tailwinds for Dell's new IT focus. To steal a paragraph from one of my previous articles about Dell:

Global spending on IT products and services will top $3.6 trillion in 2012, buoyed by the rise of cloud computing. This trend shows no sign of slowing down, either. Enterprise spending on cloud services is expected to double from $109 billion in 2012 to $207 billion by 2016.

For those who believe that Dell won't be able to make the transition from PC-maker to enterprise solutions provider, think again. Dell's enterprise customers seem to be pretty happy:

"The development of this hub is one of the most significant alliance IT developments since oneworld was established more than a decade ago," said oneworld IT Director Jouni Naskali. "Thanks to the latest cloud integration technology from Dell Boomi, the IT hub dramatically speeds up and simplifies the addition of new airlines to the alliance, making the entire process substantially more efficient and cost effective - both for the new joiners and for our established carriers."

Seems like Dell's doing a pretty good job in enterprise solutions, huh? Maybe that's why, in the midst of an otherwise dismal quarter, the Enterprise Solutions and Services segment grew revenue by 6%.

Dell's Shareholder-Friendly Policies

Dell broke with tech tradition earlier this year when it initiated a dividend. At 8 cents a quarter, the dividend is good for a 2.8% yield at the current stock price, which is ahead of the yields of some blue chip DGI stocks like Wal-Mart (WMT) and Coca-Cola (KO). Is Dell in the same "never-fail blue chip" category as Wal-Mart and Coke? Probably not. Does it make a good addition to a portfolio?

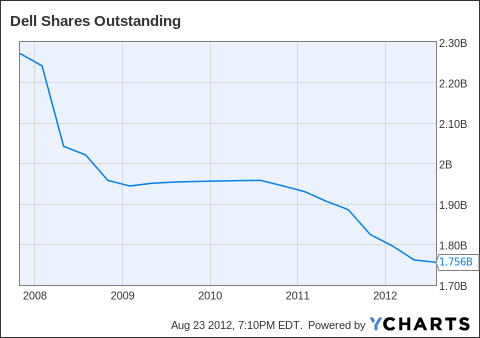

Definitely. With over $11B of cash on the books and $5.5B cash from operations, Dell isn't exactly cash-strapped. With roughly ~1.7B shares outstanding, the current 32-cent annual dividend represents a mere $544M payout per year. Dell has plenty of room to follow in Cisco's dividend-boosting footsteps.

In addition to the dividend, Dell has a nice history of buying back shares.

DELL Shares Outstanding data by YCharts

Conclusion: Dell Is A Must-Buy At This Price

By all accounts, Dell is still a very strong company. The company has healthy cash flow and is expanding in the quickly-growing enterprise market. It's undeniable that there's a rocky road ahead for PCs, however - and that's a big however - there is absolutely no indication that the PC is collapsing, and it's foolish to think that Apple has the computing market cornered always and forever. Even if PC sales continue to decline, when you factor in growth from enterprise services, there's absolutely no justification for Dell's absurdly low valuation. Pretend for a minute that Dell shutters its PC division entirely. Accounting for the fact that 50% of Dell's gross margin is not the PC, in this hypothetical scenario, Dell would STILL trade for a P/E below the broader market.

That's how cheap Dell is. Strip the name off for a second and consider the following. If you would buy an enterprise solutions provider with strong growth for a below-market P/E, then why wouldn't you buy that same provider with a PC division thrown in for free?

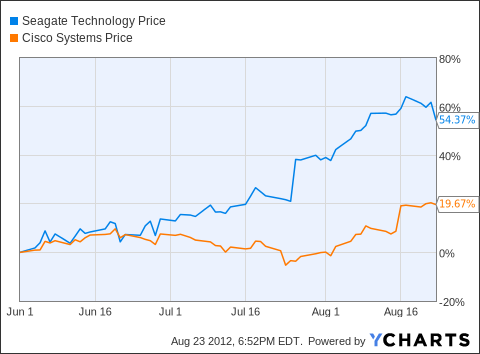

So what will happen to Dell's share price? Don't rule a quick jump out of the question - look at what happened to "old tech" peers Cisco and Seagate did.

STX data by YCharts

Personally, though, I'd prefer a nice slow and steady climb. The longer the market undervalues Dell, the longer I can continue building my position with fresh capital and reinvested dividends - and the better my profits when the market finally realizes Dell isn't dying.

For investors with a 3-5 year time horizon, Dell presents a fantastic buying opportunity. Don't pass it up.

Disclosure: I am long DELL, CSCO, HPQ, INTC, KO, MSFT, STX, WMT. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

micron ceo glenn miller who do you think you are superpac steve appleton bishop eddie long madonna give me all your luvin video

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.